You Can’t Wrap a Leased Vehicle: Contrary to the belief, many companies wrap leased vehicles and is a common practice. Leased vehicles are wrapped across the country day in and day out – without incident and damage. Wraps bring out the vehicle underneath the brand and can be removed easily prior to returning your lease. To cover your bases, check the lease agreement prior to wrapping your vehicles.

A Vehicle Wrap will damage your paint:

Not true – a vehicle wrap can actually protect your paint. Paint that is fully cured and in quality condition allows wraps to further prevent exposure to UV rays and corrosion from various elements like dirt, water, and resins. Vehicles, leased or not, are valuable assets to companies. Protecting these assets from damage is of utmost importance. To avoid any paint issues to the proper steps to perform pre-wrap inspections of the car to cautiously and appropriately remove the wrap or digital graphics. Window Graphics are not safe:

Yes, you can see through window graphics. They just have to be printed on perforated window film. This film has very small holes, allowing drivers to see out the window to the same extent of an uncovered window. Vertical windows are better to place graphics, as the visibility will be better. Low-angle rear windows, like those on Prius, make poor candidates for window graphics. Think vertical and your windows will portray the right messaging at the right angle and time.There are no new creative ideas:

Ideas are always flowing. You can make a wrap look about any way you’d like it to. Many brands have trouble thinking and decided on something cool and unique. But that’s no problem, we’ve got you covered – literally.Anyone can do it:

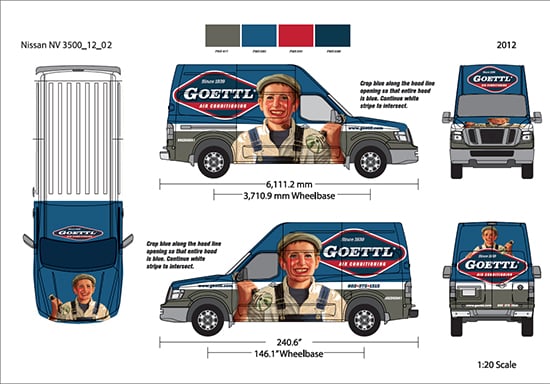

for use and how to prepare the vehicle for installation of simplistic or challenging wraps. When investing in a vehicle wrap, check out the company’s certifications and warranties. azpro is proud to say we are 3M, DI-NOC certified installation company through the UASG (United Application Standards Group) as well as a master certified business through the PDAA (Professional Decal Applicable Alliance).

for use and how to prepare the vehicle for installation of simplistic or challenging wraps. When investing in a vehicle wrap, check out the company’s certifications and warranties. azpro is proud to say we are 3M, DI-NOC certified installation company through the UASG (United Application Standards Group) as well as a master certified business through the PDAA (Professional Decal Applicable Alliance). They aren’t worth the investment:

Many have very distinct thoughts to this myth. The answer is most likely dependent on the different types of businesses and vehicle purpose. But when you begin to compare the cost to traditional paid advertising, a larger picture is painted. Once your vehicle is wrapped, you have no continuous media cost. You no longer have to pay for ad space or air time, as your vehicle is delivering your messaging for your brand. Wraps always beat traditional paid media when it comes to cost per impressions. These are some the most common myths that people assume when it comes to vehicle wraps. As we’ve pointed out, the price is right, it’s safer than believed to be, and ultimately the return on your investment is one not to regret. When searching for an efficient and affordable way to advertise your business, a vehicle wrap is an effective decision. Let us know how we can bring your company vehicle or fleet to life with vinyl! ]]>